Key economist warns of grave economic consequences if trade talks do not progress

- Alexangel Ventura

- Jun 17, 2025

- 2 min read

Economist Ernie Tedeschi of Yale University voiced his concerns with the future state of the economy if current trade talks fail.

New data that came out this week showed tremendously lower rates of trade flow to the Port of Los Angeles, one of the busiest ports in the United States. The port effectively manages most of the nation's shipping to and from China, Japan, Southeast Asia, India, and other countries from across the Eastern Hemisphere.

The statistic showed that the southern California container gateway, a very accurate indicator of trade volume, grew by 717,000 twenty-foot equivalent units across a ten-month period, a 5% decline from this same time last year.

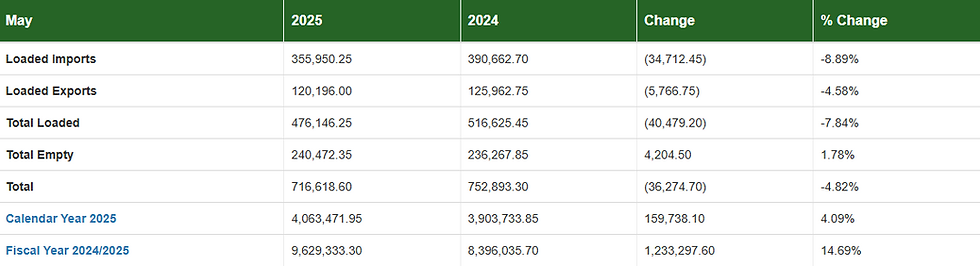

In addition, imports fell 9% against last year and 19% from April. Exports fell 5% to 120,000 units.

“Tariffs to date announced in 2025 raise the average effective tariff rate in the United States by an additional 12 percentage points," Tedeschi stated in a briefing in response to the data. In other words, this is a 1.5% increase in prices for all American consumers, which effectively reduces their purchasing power by about $2,500 per family per year.

Port of Los Angeles Director Gene Seroka joined Tedeschi in the same briefing to the people. “May marked our lowest monthly cargo output in over two years,” Seroka cited. “While May volume is typically stronger than April as we approach our traditional peak season, our imports dropped 19% compared to last month.

“Unless long-term, comprehensive trade agreements are reached soon, we’ll likely see higher prices and less selection during the year-end holiday season,” Seroka stated. “The uncertainty created by fast-changing tariff policies has caused hardships for consumers, businesses and labor.”

Seroka also pointed out how this trend is expected to continue into the summer, with lower rates of trade volume set to exacerbate.

This data fits like a glove to May's CPI report which showed increasing rates of inflation, with the CPI rising 0.1%. Also, many businesses across the United States have already announced or implemented price hikes, like Walmart and Best Buy.

In response to this data among other statistics, President Trump and his administration have opened up trade talks with other countries to bring rates down before an even more significant economic symptom occurs. Trump, in the G7 summit, achieved a landmark agreement with the United Kingdom to bring tariff rates down with some concessions. Also, China-U.S. trade talks have continued with both sides eager for reduced rates. Even China saw lower trade volumes, with its rate of exports falling 34% with the U.S. alone.