May CPI Analysis

- Alexangel Ventura

- Jun 11, 2025

- 2 min read

With the release of CPI data from the month of May on Wednesday morning, investors got a good idea as to how the economy is performing amid wide-scale trade wars.

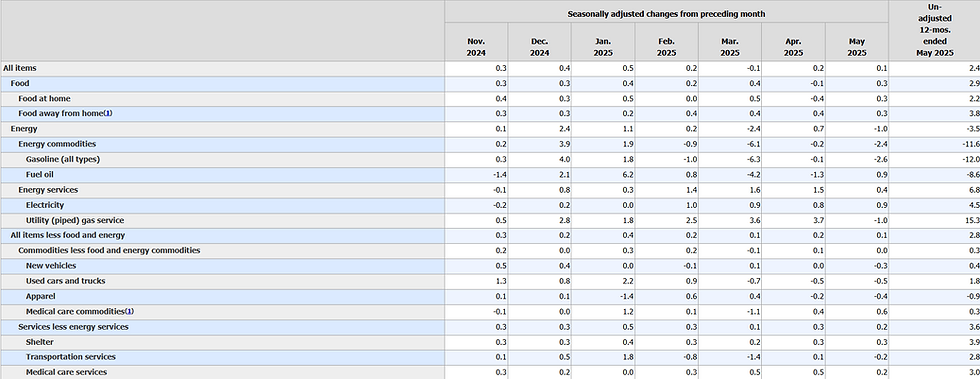

As per the United States Bureau of Labor Statistics, the Consumer Price Index (CPI) on all goods rose by 0.1% on the month after a 0.2% rise in April, and a 2.4% rise over the year. Core inflation (not food and oil) rose by a similar 0.1%, again a decrease from April's 0.2%.

In addition, the index for shelter rose 0.3% in May, and was shown to be the leading factor in the 0.1% rise in CPI.

For consumers and investors alike, although this is not the best news, it was definitely better than expectations. Economists and investors alike, including the reputable Bloomberg, predicted a 0.2% rise in CPI, which soon became an overestimate. Many based their rating on the recent escalation of trade conflicts, as well as the stalling of trade negotiations between the United States and China.

But it is important not to undermine how this data still reflects a shift in the economy to a more inflationary environment. Although they overestimated their predictions, analysts were right in that tariffs/trade wars played a key role in rising prices. In the month of May, the federal government proceeded with job freezes, some companies like Best Buy announced price hikes, and the key court ruling deeming Trump's tariffs illegal as they exceeded the boundaries set by the International Emergency Economic Powers Act (IEEPA).

Ultimately, consumers will pay the price for these inflation hikes. Student loans jumped by 7.7% in Q1 2025, Mortgage delinquencies rose by nearly 0.3%, and in April total consumer credit rose by $17.9 billion (all data from the NY Fed).