TheDrop Market Analysis, 03/17/25

- Alexangel Ventura

- Mar 17, 2025

- 2 min read

Markets generally moved upward in a promising sign for the economy.

Markets were generally bullish; the Dow rose 0.9%, the S&P 500 rose 0.6%, and the Nasdaq rose by a smaller 0.3%. In addition, the Russell 2000 index, one of the leading indicators of the strength of small business, rose by an outstanding 1.2%. The index was previously a market underperformer as smaller stocks generally reacted more strongly to President Trump's tariff policies, CPI data, and other market events/trends.

Why were markets surging today? Perhaps the most logical conclusion to this question is the fact that most stocks have reached unsustainable lows that most likely will not continue to last in the long term. Indeed, the nature of stocks is after a period of drastic decline, buying pressure comes in and sends them surging into a recovery. This was exactly what unfolded today: making use of the corrective territory of most stocks, investors took it to Wall Street to buy in droves cheap stock, thus setting capital surging almost everywhere.

Also, Trump's trade war took a major turn when the president expressed interest in possible exemptions to some of his already implemented tariff rates, especially through negotiations with Canada and Mexico. However, the president has remained firm in his position regarding most tariffs, that they should remain high. In doing so, many economists projected some of America's most targeted trading partners like China to suffer drastic negative consequences in regards to each of their economies, particularly inflation. Now, many central banks across the globe are expressing interest in increasing interest rates, giving American bondsmen a better opportunity to acquire more loans compared to the rest of the world. Furthermore, recent CPI data showed that, at least for now, inflation is cooling despite the tariffs, giving investors some confidence today. Nevertheless, the long term impact of tariffs has not yet been realized, so take this data with a grain of salt.

Most stocks, as stated earlier, trended upwards as they begin heavy correction. CrowdStrike rose 3.1%, Intel rose 6.8%, Apple rose 0.2%, and Target rose by almost 1%, to name a few. Even President Trump's own Trump Media rose 1.7%, as investors now have a more favorable view of the president, as indicated by polls showing that the president's approval rating is rising from last week's lows.

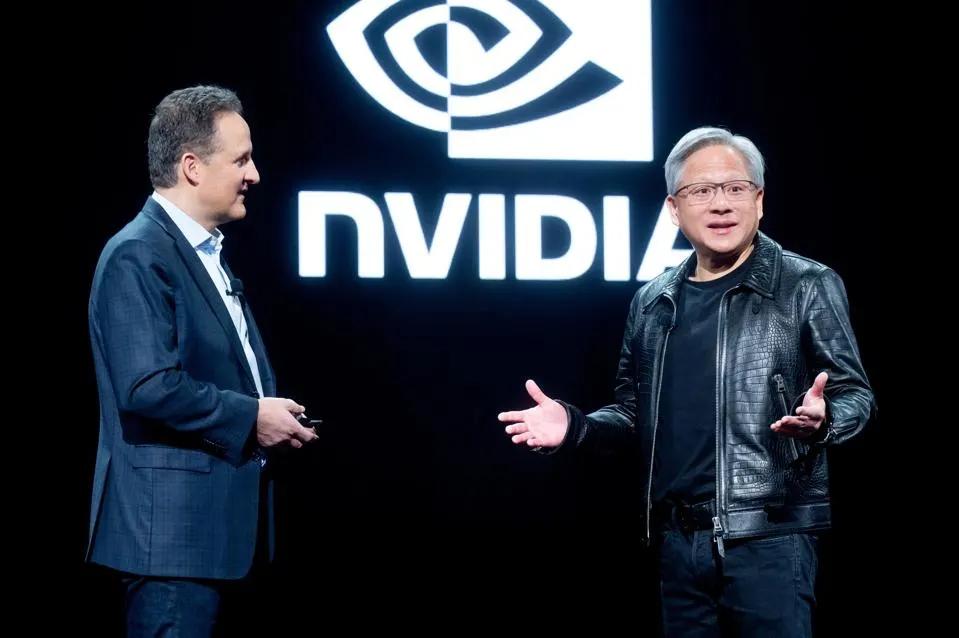

Despite the general consensus by investors that now is the right time to buy stocks, some evacuated from select companies out of fear. Nvidia, which is going to have an annual conference tomorrow, fell by 1.8%, perhaps because investors anticipate the chipmaker to not outperform expectations once again, like in its February earnings report. Tesla, another member of the Magnificent Seven, fell by 4.8% as investors react poorly to the automaker's new operations in China to promote self-driving cars.